Managing money doesn’t have to be confusing or stressful. With the best financial tips, anyone—regardless of income level—can take control of their finances, reduce anxiety, and create a secure future. Whether you’re just starting your financial journey or trying to fix past mistakes, smart money habits can change everything.

This guide breaks down practical, easy-to-follow strategies that real people use every day. No jargon. No unrealistic promises. Just clear, honest advice you can apply immediately.

Understanding the Importance of Financial Literacy

Financial literacy is the foundation of smart money management. It helps you make informed decisions, avoid costly mistakes, and plan for both short- and long-term goals.

Why Financial Knowledge Matters

- Prevents unnecessary debt

- Improves decision-making

- Builds confidence with money

- Supports long-term wealth creation

Common Financial Mistakes People Make

- Living beyond their means

- Not saving early

- Ignoring emergency funds

- Relying on credit cards

According to Investopedia (https://www.investopedia.com), financial education directly impacts long-term financial stability and wealth-building success.

Best Financial Tips for Building a Strong Foundation

These core principles apply to everyone, regardless of age or income.

Create a Realistic Monthly Budget

A budget tells your money where to go instead of wondering where it went.

- Track income and expenses

- Use the 50/30/20 rule

- Adjust monthly as needed

Pay Yourself First

Before spending on anything else, set aside money for savings. Automate it if possible.

Build an Emergency Fund

Aim for 3–6 months of living expenses to protect against job loss or emergencies.

Smart Saving Strategies That Actually Work

Saving isn’t about deprivation—it’s about intention.

Start Small but Stay Consistent

Even $10 a week adds up over time. Consistency matters more than amount.

Use High-Yield Savings Accounts

Your money should work for you, not sit idle.

Set Clear Savings Goals

Examples:

- Vacation fund

- Home down payment

- Education

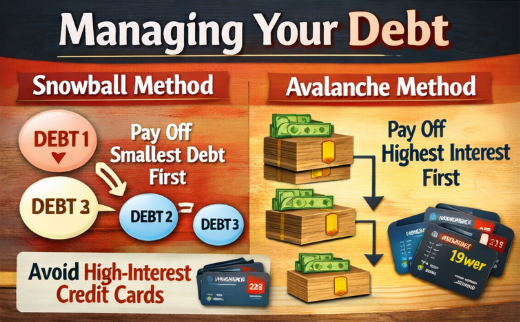

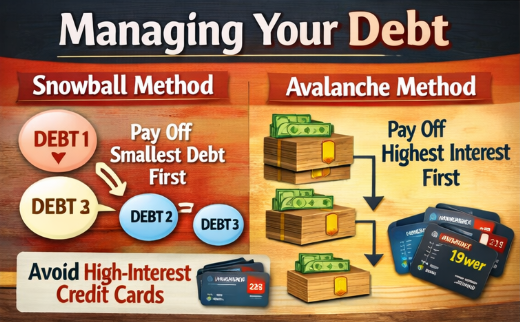

Debt Management Tips You Should Follow

Debt can block financial progress if not handled wisely.

Understand Good vs Bad Debt

- Good debt: education, mortgage

- Bad debt: high-interest credit cards

Use the Snowball or Avalanche Method

- Snowball: pay smallest balances first

- Avalanche: pay highest interest first

Avoid Lifestyle Inflation

Just because you earn more doesn’t mean you should spend more.

Investing Basics for Long-Term Wealth

Investing is essential for beating inflation and growing wealth.

Start Investing Early

Time in the market matters more than timing the market.

Diversify Your Portfolio

Spread risk across:

- Stocks

- Bonds

- Index funds

- ETFs

Think Long-Term

Avoid emotional investing. Stick to your strategy.

Best Financial Tips for Daily Money Habits

Small daily actions create big results.

Track Every Expense

Awareness leads to better decisions.

Use Cash or Debit More Often

This reduces impulse spending.

Cancel Unused Subscriptions

Streaming services, apps, and memberships add up fast.

Protecting Your Financial Future

Security is just as important as growth.

Get Proper Insurance

- Health

- Auto

- Home

- Life

Plan for Retirement Early

Take advantage of employer-matched retirement plans.

Create a Simple Financial Plan

Include:

- Goals

- Timelines

- Risk tolerance

Financial Tips for Different Life Stages

In Your 20s

- Build credit responsibly

- Start saving early

- Learn investing basics

In Your 30s–40s

- Increase retirement contributions

- Reduce high-interest debt

- Plan for family expenses

In Your 50s and Beyond

- Protect assets

- Reduce risk

- Focus on income stability

Psychology of Money: Mindset Matters

Your beliefs about money influence your behavior.

Avoid Emotional Spending

Pause before purchases.

Practice Gratitude

Contentment reduces unnecessary spending.

Focus on Progress, Not Perfection

Financial growth is a journey, not a race.

Frequently Asked Questions (FAQs)

What are the best financial tips for beginners?

Start with budgeting, saving consistently, and avoiding unnecessary debt.

How much should I save each month?

Ideally, at least 20% of your income, but any amount is a good start.

Is investing risky?

All investing carries risk, but long-term diversified investing reduces it.

Should I pay off debt or save first?

Do both—build a small emergency fund while paying down high-interest debt.

How can I improve my financial discipline?

Automate savings, track expenses, and set clear goals.

Are financial advisors worth it?

They can be helpful, especially for complex financial situations.

Conclusion: Take Control of Your Money Today

The best financial tips are not about getting rich overnight—they’re about building habits that protect your future. Start where you are, use what you have, and stay consistent. Financial freedom is possible when smart decisions become daily habits.